Financial Asset Management

ALL-ROUND FINANCIAL OVERSIGHT

We specialise in optimising the performance and profitability of your solar PV and BESS projects. Our comprehensive suite of services is designed to support every financial and commercial issue of your renewable assets, ensuring they operate efficiently and meet all regulatory and financial obligations. From meticulous commercial asset management and precise tax management to rigorous loan compliance and tailored financial services, our team of experts is dedicated to safeguarding and enhancing the value of your renewable energy projects.

FINANCIAL ASSET MANAGEMENT SERVICES

Without commercial management, effective asset management cannot take place, and the success of a renewable project is jeopardised. Knowing that an expert team of financial professionals is working hard on your project not only brings confidence, it assures profitability through business efficiency. With clients across Spain, Italy, and the UK, Quintas commercial services financially safeguard projects in the construction and operational phases.

-

Standard Accounting & Taxes

-

Financial Management

There are few more essential parts of a commercial project than its income. Our team carefully tracks, logs, accounts for, and oversees collection of all incoming funds.

Whether capital or revenue spending, we keep close tabs on all expenditure, ensuring that it stays within budget and that all financial outflows are documented.

The backbone of financial organisation. Our professional team provides a clear overview of a project’s commercial health, recording, categorising, and summarising all transactions with regular reports.

These legally mandated reports detail annual project performance and financial status. While preparing them, we keep clients and third parties informed of performance matters, factors requiring attention or other potential issues.

Quintas professionals carry out diligent bookkeeping services, including VAT registration, VAT returns, and Tax Claims Management, as well as offering tax advice.

Top-level assistance to set up and manage SPVs and holding companies, including preparing for board and shareholder meetings, registration of any corporate changes, maintaining the books, filing annual accounts and legal compliance.

We undertake in-depth pricing and production analysis to maximise revenues, as well as carrying out reconciliation exercises, and file claims regarding any discrepancies discovered, among other tasks.

We seek ways to optimise cashflow, cut costs and make best use of resources to manage liquidity. These include payment management, purchase order approvals, stakeholder management, etc.

We prepare and supervise annual budgets for SPVs, detailing projected income and expenses, issuing a balance sheet and cash flow statement, and setting benchmarks for performance.

We scrutinise records and procedures to ensure a successful audit of the client’s annual accounts, providing auditors with all the data needed for an audit opinion.

TAX MANAGEMENT SERVICES

With good tax management, a solar portfolio can optimise its fiscal obligations, while maintaining full compliance with national and regional tax regulations. Including a rigorous assessment of the tax situation as part of a project’s business plan is an essential part of providing a solid foundation for revenue growth.

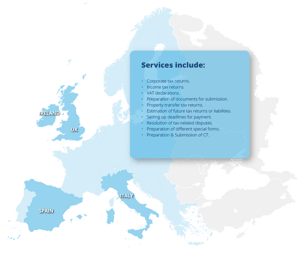

Quintas Energy offers comprehensive tax compliance in the UK and Ireland and tax management services for Italy and Spain, where we have a dedicated team of Italian commercialistas and Spanish Tax experts with expertise in their country’s complex and overlapping regulatory regimes.

KNOWLEDGE AND EXPERIENCE WORKING TOGETHER

Our country experts have the specific tax and financing knowledge required to provide you with expert commercial asset management services and optimise your solar investments, wherever they may be.MEET OUR EXPERT TEAM