Optimise Revenue Management for Accurate Revenue Estimation

This case study presents the successful application of an automated solution to collect daily production and price data from a portfolio of 500 PV installations in Spain, operating under a mixed PPA and market scheme. The solution estimates revenues based on hourly market prices and contractual PPA prices. It calculates the monthly deviation between the production invoiced by the offtaker and actual production, and in cases of discrepancy, automatically files claims against the offtaker. This solution has significantly improved the accuracy of revenue estimation, reduced uncertainty in the provisioning process and optimised the discrepancy claim process.

CONTEXT

The client, a prominent company in the energy sector, managed a large proprietary portfolio of 500 PV installations in Spain, with an average size of 5MW and a mixed energy sales scheme (a percentage of the production sold under PPA, the rest under market price). Guaranteeing accurate revenue forecasting and contractual compliance was essential to ensure the profitability of the investment.

CHALLENGES

The client faced the following challenges:

- High Volume of Data: The monthly download of production and market price data and the normalisation of contract prices involved a huge amount of data processing on the part of the management team.

- Complexity of Calculations: The manual evaluation of revenues considering PPA and market required the implementation of complex contractual calculations, with the consequent risk of errors.

- Manual Process: The process of comparing production invoiced by the offtaker and actual production at the meter level was slow and

required constant follow-up. - Claims Management: The lack of automation made it difficult to file accurate and timely claims for discrepancies in the volume of assets under management.

SOLUTION

Quintas Analytics designed and implemented a complete automated solution to address the challenges mentioned above:

- Data Integration: An automated system was created to collect production and market price data, and normalise contract prices under the PPA.

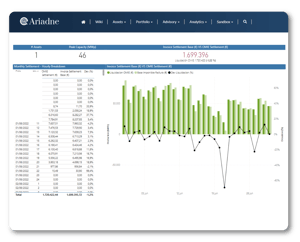

- Revenue Estimation: The developed solution calculated estimated revenues based on hourly market prices and contractual PPA prices.

- Deviation Calculation: An algorithm was devised to compare invoiced production with actual production, detecting monthly deviations.

- Automatic Reclamations: In the event of a discrepancy, the solution automatically filed claims with the offtaker by email, describing the asset and period affected and attaching the necessary documentation.

RESULTS AND BENEFITS

Implementing the solution had a significant positive impact on the accuracy of revenue provisioning and the operational efficiency of the management team:

1. Accurate Revenue: The automatic estimate, taking into account hourly PPA and market prices and the corresponding percentage of production, significantly reduced manual errors and improved the accuracy of revenue provision.

2. Time Saving: The automated process eliminated the need to perform manual calculations in MS Excel for 500 installations and reduced the time required for revenue provisioning, being available the day after month-end.

3. Optimisation of Reclamations: Automatic claims allowed for a quick, accurate and well-founded response to discrepancies with the energy billed by the offtaker.

4. Risk Management: The solution reduced the risk of mis provisioning and improved transparency in the revenue management process.

5. Improved Efficiency: The management team was able to focus on strategic decision making, rather than repetitive manual tasks.

CONCLUSIONS

The solution implemented for automated revenue provisioning, variance calculation and claims in a PV portfolio with a mixed PPA and market scheme proved a great success in terms of revenue accuracy and operational efficiency for the management team. The automation of calculations, the matching process and automated claims provided essential tools for effective and profitable management. This solution sets a valuable example for the management of similar solar PV projects in diversified markets.