Optimise the Monthly Reporting Process of Photovoltaic Portfolios

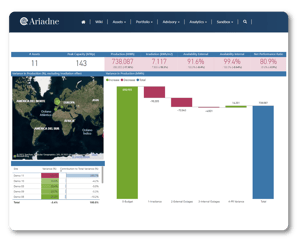

This case study highlights the successful implementation of an automated solution that integrated data from multiple sources to assemble a monthly status report of a portfolio of 50 PV assets with an average capacity of 10MW. The report included description, analysis, and comparison with the expected values of the financial model of the main technical and financial KPIs. This automation allowed the asset management team to save time in its reporting process and minimise manual errors, improving operational efficiency.

CONTEXT

The owner of the PV portfolio, consisting of 50 assets with an average capacity of 10MW, faced the challenge of performing comprehensive and accurate monthly reporting on the status of the portfolio, including technical and financial KPIs.

CHALLENGES

The owner faced the following challenges:

- Diverse Data Sources: The data required for reporting came from different sources, making manual integration difficult.

- Complexity in the Analysis: Analysing technical and financial KPIs manually was time consuming and prone to human error.

- Comparative Financial Model: Comparing the results with the values expected in the financial model was a laborious process.

SOLUTION

Quintas Analytics developed an automated solution to address the above challenges:

- Data Integration: The automated solution integrated data from multiple sources, including SCADA, meters, pricing, billing, operating expenses and financial models.

- Automated Report Generation: A comprehensive monthly report was created, describing the state of the portfolio and analysing the key technical and financial KPIs.

- Comparison with the Financial Model: The results were automatically compared with the expected values found in the financial model.

RESULTS AND BENEFITS

Implementing the automated solution had a positive impact on portfolio management:

1. Time Saving: The reporting process was made much faster and efficient, reducing the manual workload.2. Improved Decision Making: Faster, more accurate analysis enabled better informed asset management decisions.

3. Error Reduction: Automation minimised human error in data analysis, and comparison with the financial model.

4. Improved Visibility: The report provided a complete and detailed overview of the state of the portfolio.

CONCLUSIONS

The solution implemented for monthly reporting in a PV portfolio significantly improved operational efficiency and the quality of information available for decision making. Automation in data integration, reporting and comparison with financial models allowed the asset management team to focus on interpreting results and improving portfolio profitability. This approach can serve as a model for managing similar assets in a diverse operating environment.